The Impact of Financial Health on Mental Well-being

The Relationship Between Financial Health and Psychological Well-being

In the past five years, the prevalence of enduring stress and persistent health issues has surged to alarming levels among individuals aged 35–44, rising from 48% in 2019 to 58% in 2023. Within the same age bracket, there was a significant uptick in mental health diagnoses, escalating from 31% in 2019 to 45% in 2023. However, the highest reported rate of mental health conditions is among adults aged 18–34, standing at 50%. These statistics underscore the urgent need for action to address the financial health crisis.

Individuals aged 18–44 constitute more than 89 million workers, representing approximately half of the U.S. workforce. This translates to a substantial portion of your workforce potentially grappling with persistent stress, chronic illnesses, and mental health ailments. The data undeniably underscores the widespread impact on employee mental well-being over the past few years.

The underlying issue behind these statistics is simply money. Financial concerns are a primary stressor for over 80% of 18–34-year-olds and 77% of 35–44-year-olds. The nexus between financial well-being and mental health is palpable. Attaining financial stability at an early stage enhances the prospects of ameliorating mental health.

The Inextricable Link Between Financial Well-being and Mental Health

The 2022 SmartDollar Employee Benefits Study uncovered concerning statistics that underscore the link between employee financial wellness and mental health:

47% of employees lose sleep due to personal financial concerns.

55% of employees fret over their personal finances daily.

36% of employees have missed work due to financial issues.

45% of employees have experienced distractions at work stemming from financial problems.

24% of employees are either grappling with financial instability or are in a financial crisis.

The recurrent themes here are sleep deprivation, worry, absenteeism, distraction, struggle, and crisis. Issues of this nature don’t confine themselves to the home; employees unavoidably carry them to the workplace. Fatigued, anxious, or distracted employees are unlikely to be as productive and engaged as they could be without financial worries. Poor mental health is detrimental to your business, manifesting in various ways, such as absenteeism, burnout, irritability, low motivation, and physical ailments.

Stress and anxiety trigger the fight-or-flight responses that kick in when the body perceives threats.

Consequently, when financial concerns consume employees, their stress responses go into overdrive. They may feel powerless in combatting their economic challenges, yet evading them is not an option. They find themselves paralyzed in this predicament.

The Financial Health Network categorizes financial wellness into three tiers: financially stable, managing, and insecure. The research shows that 75% of financially stable individuals rate their mental well-being as “excellent” or “very good,” In contrast, only 44% of financially managing and a mere 21% of financially insecure individuals echo the same sentiment. It is worth noting that financial stability is not solely determined by income. Even individuals with six-figure salaries can fall into the financially managing or insecure brackets if their entire income is funneled back into monthly debt payments.

A recent study featured in the National Library of Medicine establishes a strong association between debt and mental disorders, including depression, suicide, problem drinking, drug dependence, neurotic disorders, and psychotic disorders. Regrettably, some individuals face a more profound struggle. Adults carrying a debt burden are three times more likely to attempt suicide than those unencumbered by debt.

The overarching conclusion is clear: the financial wellness, or lack thereof, of your employees significantly influences their mental health.

Economic Stability Enhances Employee Mental Health

The 2022 SmartDollar Employee Benefits Study indicates that 56% of employees perceive they cannot progress financially, while 60% feel behind in preparing for retirement. Alarmingly, 33% of Americans have zero savings, indicating that some of these individuals could be your employees.

As technology continues to shape the future of work, platforms like Your Career Place play a crucial role in connecting professionals with meaningful career opportunities. With a user-friendly interface and personalized job-matching algorithms, Your Career Place offers a streamlined approach to job searching. By leveraging such innovative platforms, job seekers can access a wide range of job listings tailored to their skills and experience, ultimately enhancing their job search experience.

These individuals lack savings, retirement provisions, and peace of mind. There is a definitive correlation between financial wellness and mental health. As financial well-being improves, so does mental health. Conversely, inadequate financial stability can undermine the mental health of employees.

Thankfully, employers are not bereft of solutions regarding aiding their employees in enhancing their financial circumstances. They possess the means to assist employees in resolving their financial struggles and alleviating their financial stress. More importantly, employees actively seek such assistance—over 70% desire additional resources from their employers to help manage their finances. This underscores the crucial role employers play in addressing this issue.

What is the financial wellness benefit?

A financial wellness benefit encompasses any program designed to aid employees in navigating money-related challenges. Following the implementation of SmartDollar, a financial wellness benefit, employees reported noteworthy progress, as delineated by The 2022 SmartDollar Employee Benefits Study:

60% of employees experienced an improvement compared to the previous year, and 30% were without access to a financial wellness benefit.

27% of employees reported diminished stress regarding personal finances.

29% of employees are actively saving for retirement.

25% of employees are accruing funds for an emergency reserve.

24% of employees are equipped with the knowledge to plan for retirement.

SmartDollar is a comprehensive financial wellness benefit that imparts insights into budget adherence, debt management, future savings, and secure retirement planning. It is a premier resource empowering employees to navigate financial management challenges using tools like EveryDollar, a budgeting app, and Financial Peace University, a program that teaches financial planning and management skills.

The Impact of Employee Mental Health on Your Business

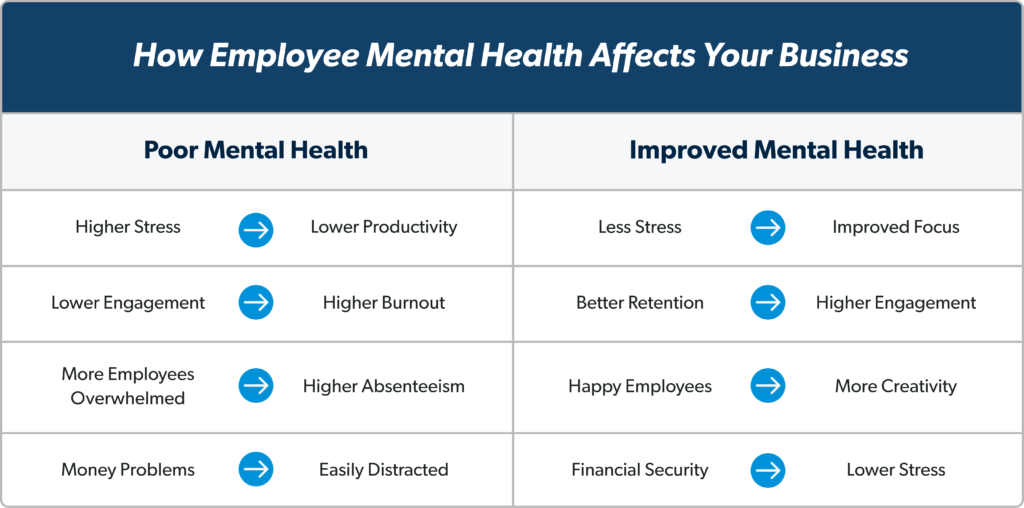

Employees who exhibit financial discipline and work towards their financial objectives emerge as a resilient workforce. The detrimental impact of financial issues on employees’ mental well-being, fostering stress and anxiety throughout the day, is evident. However, flipping the narrative yields business benefits.

Upon scrutinizing how employee mental health interacts with your business, the following observations emerge:

The Role of Employers in Fostering Well-being

Financial stability, work performance, and mental health are intertwined and require continuous monitoring, evaluation, and support. Employers like yourself are constantly exploring innovative methods to enhance employee mental well-being. A financial wellness benefit could be the solution to addressing this concern. Discover how financial wellness initiatives can alleviate employees’ financial stress and bolster your business.

Thank you for stopping by Your Career Place. We are eager to help you along your career journey. Remember, by offering financial wellness benefits, you cannot only alleviate your employees’ financial stress but also bolster your business by fostering a resilient and productive workforce.

Related articles from your friends at Your Career Place.

https://yourcareerplace.com/lifestyle/transform-your-health-with-these-12-easy-habit-adjustments